If your business is involved in VAT exempt and VAT taxable activities and consequently is only entitled to partial VAT recovery, it’s time to carry out the mandatory annual VAT recovery rate review for 2018 if your business has a 31 December accounting year end.

The adjustment should be included in the May/June 2019 VAT return, which must be filed by 23 July, otherwise statutory interest applies.

What is a VAT recovery rate?

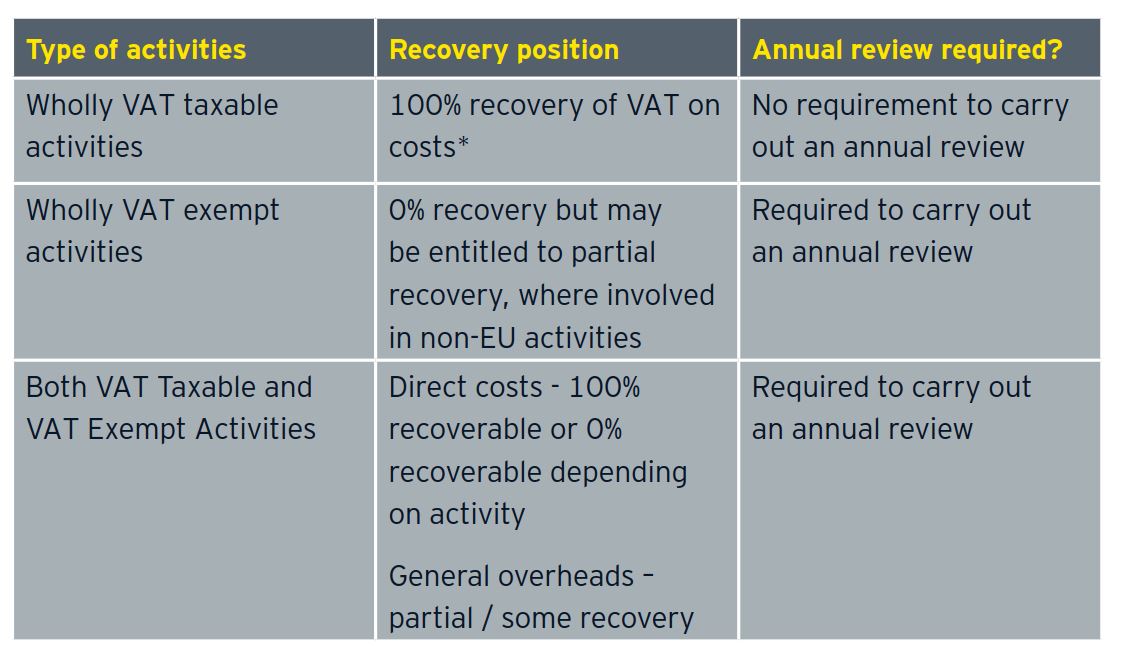

A VAT recovery rate is the portion of VAT incurred that an entity is entitled to deduct. Different entities are entitled to deduct different amounts of VAT depending on the activities they are engaged in – the following is a useful summary:

In general a turnover based methodology must be applied to calculate a partial VAT recovery rate. This involves a business involved in both taxable and exempt activities calculating its turnover from taxable activities as a percentage of its total turnover. The resulting percentage is the entity’s VAT recovery rate. If turnover does not correctly reflect either how your business uses overhead costs or the range of activities and supplies undertaken by your business, you can consider using other methodologies to calculate a partial VAT recover rate, such as, staff usage, number of transactions, floor area etc.

Morgan Stanley Judgment – impact for groups with branches

If your Irish based business supports a foreign head office or foreign branch, then a European Court of Justice judgment earlier this year in the case of Morgan Stanley (C-165/17) could add additional steps to your recovery rate calculation. We would be happy to discuss the potential impact of this case on your business.

EY’s approach to VAT recovery rate reviews

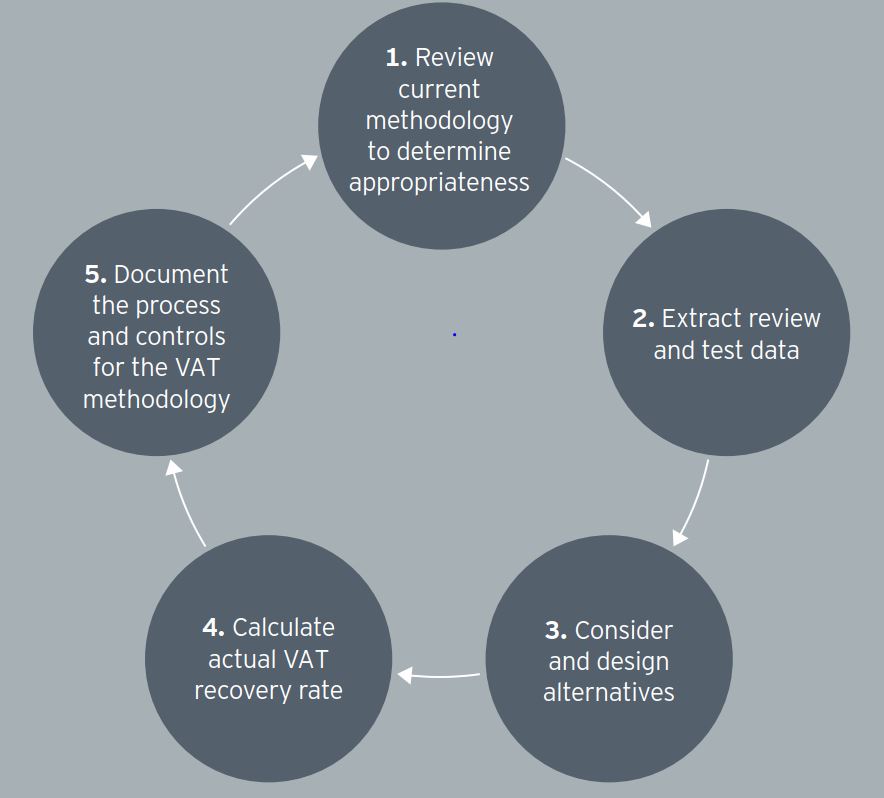

Our dedicated EY Financial Services VAT team has a huge amount of experience in advising financial services companies on their VAT recovery methodologies, and over the years we have developed our approach to ensure minimal disruption to your business while maximising the amount of VAT you are entitled to recover. Our approach involves a number of key steps (some, or all of which, may be required depending on your set-up):

If required, we can also assist and prepare submissions to Revenue if your business would like its VAT recovery rate methodology approved or if a new methodology results in a large positive VAT adjustment.

If it is:

then EY would be delighted to talk to you about how best to fulfil your VAT adjustment obligations and what opportunities there may be for your business. For additional information, please contact any of our specialist FS VAT team (contact details below) or fsvatcompliance@ie.ey.com:

Eamonn McCallion eamonn.mccallion@ie.ey.com +353 1 221 1648

Brian Keenan brian.keenan@ie.ey.com +353 1 221 2487

Aideen Farrell aideen.farrell@ie.ey.com +353 6 144 9896

Karl Smyth karl.smyth@ie.ey.com +353 1 221 1790