EY’s Muntasir Khaleik, Wealth and Asset Management Director, writes about the Sustainable Finance Disclosure Regulation for Finance Dublin.

You may also be interested in reading our latest guidance on this topic: Sustainable Finance Disclosure Regulations – March 2021 and beyond.

The Sustainable Finance Disclosure Regulation (SFDR) lays down harmonised disclosure rules for financial market participants and financial advisors at the entity, service, and fund level. The SFDR will apply from 10 March 2021, with certain obligations taking effect later in the year. There are three distinct areas that fall under the SFDR’s general principles of sustainability-related disclosures: the integration of sustainability risks in investment decision-making processes; the consideration of adverse sustainability impacts in their processes, and the provision of sustainability‐related information with respect to financial products. Disclosures to end investors in these areas are insufficiently developed to date.

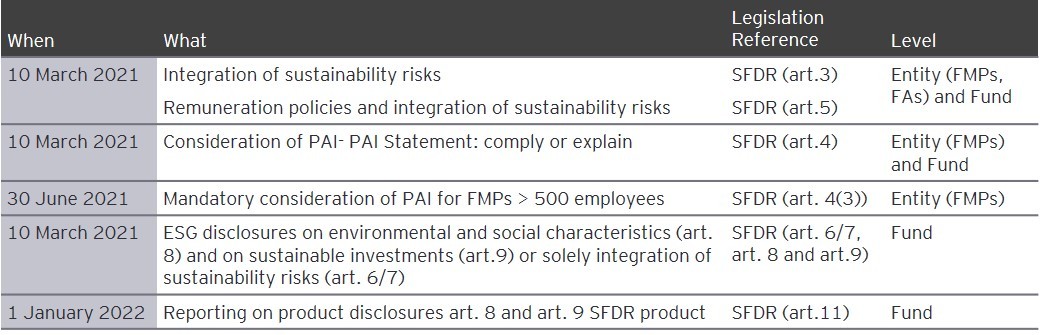

Timelines for compliance

Integration of sustainability risks

Articles 3 and 5 of the SFDR require all asset managers to publish information on their websites about their policies on integrating sustainability risks in investment decision-making processes, and include information in their staff remuneration policies about how these policies are consistent with the integration of sustainability risks.

Article 6 of the SFDR requires asset managers to disclose the following information in the prospectus: how sustainability risks are integrated into their investment decisions, and the results of an assessment of the likely impacts of sustainability risks on their funds. If a manager does not consider sustainability risks to be relevant, the pre-contractual disclosures should include a clear explanation of the manager’s reasons.

Consideration of PAI- PAI Statement: comply or explain

The Commission believes that clear identification of adverse impacts of investments on sustainability will help mobilise end investors. Article 4 of the SFDR states that in respect of both the entity-level and fund-level disclosures, asset managers have options to either consider or not to consider principal adverse impacts and publish and maintain these on their website. This is mandatory for asset managers with more than 500 employees. These managers need to start considering the principal adverse impact by 30 June 2021 at the latest.

At the fund level, asset managers may determine that sustainability risks are not relevant to a fund. However, in each case, firms must provide clear reasons as to why they do not take these into account, including, where relevant, information as to whether and when they intend to consider such adverse impacts.?

ESG disclosures for sustainable investment funds

For asset managers that promote sustainable investment funds, the SFDR provides a common framework for disclosures as to the funds’ sustainable features but distinguishes between two types of funds: those that promote environmental or social characteristics (Article 8 funds) and those funds that have as an objective a positive impact on the environment and society (Article 9 funds).

The prospectus of an Article 8 fund should include information on how the environmental or social characteristics promoted by the fund will be met, and an Article 9 fund should include how the objective of sustainable investment will be achieved. If an index has been designated for either category of the fund, as a reference benchmark, additional disclosure is required.

Where an Article 9 fund has been designated as a reference benchmark, how the designated index is aligned with its objective and an explanation as to why and how the designated index aligned with that objective differs from a broad market index should be disclosed. Where an Article 9 fund does not designate an index as a reference benchmark, an explanation on how that objective will be attained should be disclosed. Where a fund has a reduction in carbon emissions as its objective, the objective of low carbon emission exposure in view of achieving the long‐term global warming objectives of the Paris Agreement should be disclosed.

Article 10 of the SFDR states that an asset manager of Article 8 or 9 funds should also publish and maintain on its website additional information regarding the methodologies used to assess, measure, and monitor the environmental or social characteristics or the impact of the sustainable investments selected for the fund, including its data sources, screening criteria for the underlying assets and the relevant sustainability indicators used to measure the environmental or social characteristics or the overall sustainable impact of the Fund. Also, there is a requirement to include the information required for the funds’ periodic report under Article 11 of the SFDR.

Funds periodic reports

Article 8 and 9 funds need to include further disclosure about the transparency of the promotion of environmental or social characteristics and of sustainable investments in periodic reports to enable end investors to understand how funds are achieving the relevant environmental/social characteristics (Article 8 funds) or sustainable investment objective (Article 9 funds). Where the asset managers consider principal adverse impacts, information on principal adverse impacts on sustainability factors should be disclosed in periodic reports.

The SDFR provides that the periodic disclosure obligations apply from 1 January 2022. The asset management industry views this as meaning that the relevant disclosures will be required in annual reports for annual reporting periods beginning on or after 1 January 2022. This approach would enable the disclosure to cover an entire reporting period and avoid the retrospective application of the SFDR.

Information about the content, methodologies, and presentation of the disclosures of principal adverse impact disclosure, pre-contractual product disclosure, website product disclosure, and funds’ periodic disclosures was due to be published through the level two regulatory technical standards (RTS). On 23 April 2020, the European Supervisory Authorities launched a joint public consultation on draft regulatory technical standards for ESG disclosures. The consultation was open until 1 September 2020 and the final texts were expected in December 2020. The European Commission indicated it is challenging to have the Standards in place by 10 March 2021 and will become applicable at a later stage. The RTS would have provided more legal certainty, facilitate further standardisation and convergence across the financial sector. The RTS will also bring further accountability, discipline, and efficiency to financial markets and will provide improved data and information for comparability to end investors and supervisors. The Commission has been pragmatic in considering a deferral to the application of the RTS. The deferral will allow national competent authorities to prepare for the orderly and effective supervision of compliance by asset managers.

Asset managers will need to put in place a responsive technical infrastructure and develop the necessary knowledge to identify and measure impacts of investments on sustainability to comply with the high level and principle-based requirements laid down in the SFDR by March 2021.

This article first appeared in the November 2020 issue of Finance Dublin. Don’t hesitate to reach out if you have a question.