Organisational effectiveness is rising high on the agenda, with the Central Bank’s intentions to conduct assessments in 2019. Here’s what fund management companies (FMCs) need to know about meeting the requirements of CP86.

Background

In December 2016, the Central Bank of Ireland (CBI) published its final guidance on Consultation Paper 86 “Fund Management Companies – Guidance”. It came into full effect on 1 July 2018. The CBI has stated that it will assess how FMCs have implemented and embedded the Guidance, and in particular, the Organisational Effectiveness requirements.

Organisational Effectiveness and other key requirements

“Effectiveness: The degree to which objectives are achieved and the extent to which targeted problems are solved. In contrast to efficiency, effectiveness is determined without reference to costs and, whereas efficiency means ‘doing the thing right,’ effectiveness means ‘doing the right thing’.” 1

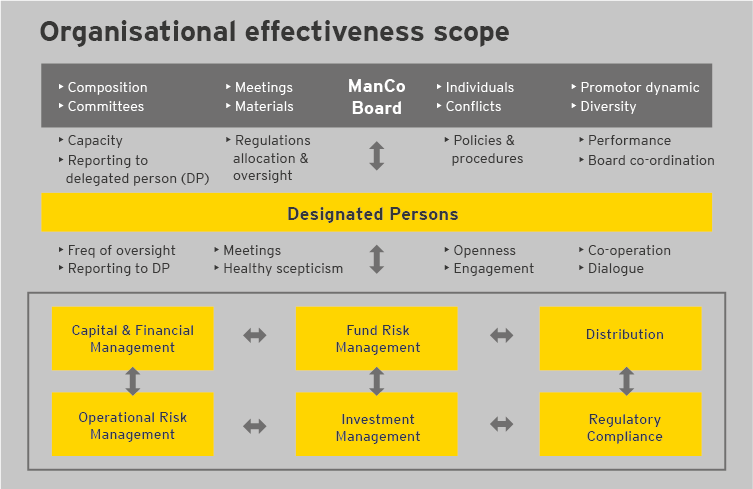

There is a requirement that there is an independent director with the specific task of reviewing the effectiveness of the FMC’s organisational arrangements. The CBI has listed examples of the activities involved, which will require submission of proposals to the board and driving the related change agenda. The Guidance identifies six distinct areas, aligned to the managerial functions, where the board of the FMC should direct specific attention in the oversight of delegates.

Organisational effectiveness and Designated Person (DP) roles – Challenges with implementation will include:

To address these challenges, FMC’s should:

The UK experience

Governance arrangements of UK FMCs will fall under the Senior Manager and Certification regime (SMCR) in December 2019. It requires firms to identify specific Senior Manager Functions (SMF), allocate Prescribed Responsibilities to each and document this on a Management Responsibilities Map. SMF holders will have to demonstrate “reasonable steps” taken to discharge the duties of their function, including oversight of delegated tasks.

The FCA will also require FMC’s to act in the best interests of investors. There will be a new responsibility under SMCR to conduct a Value Assessment. Boards, and one director personally, will have to annually attest that their funds provide value to investors. FMC’s selling into the UK may find distributors looking for an equivalent Value Assessment before listing the Irish FMC’s funds.

The CBI has formally announced it will introduce Individual Accountability, in a similar manner to SMCR, this will initially include investment managers, and may extend further than proposed. Furthermore, the CBI’s recent thematic review of UCITS Performance fees indicated that some entities may not be acting in the best interests of investors. The UK experience provides useful guidance for implementation of Organisational Effectiveness and measures to protect investors.

Conclusion

The CBI has emphasised that the culture and environment of the FMC is key to effective implementation of the Guidance. FMCs must exercise judgment in the oversight of delegates to ensure that investors’ interests are being adequately served. This duty is becoming increasingly explicit with the increased focus global regulators are placing on Investor Outcomes.

This is therefore more than a governance exercise. Proper implementation will give comfort to regulators that FMC’s are acting as the investors’ agents. Boards should expect to demonstrate this in their future supervisory engagements with the CBI to confirm that the purpose of the Guidance been properly achieved.

If you have a question about meeting the requirements of CP86, don’t hesitate to get in touch.

1 Source: BusinessDictionary.com