Please note that this article relates to the 2018 research – view our latest findings here.

Oil prices have been on a rollercoaster ride this year, climbing to four-year highs before taking a recent tumble. While the latest price drops will be welcomed by global airlines, these fluctuations will have re-emphasised the threat that rising oil prices bring to the industry.

Few industries are as oil reliant as aviation, and fuel costs relate directly to airline profits. It’s not surprising then that EY’s latest survey of global airlines found that the price of fuel is now perceived to be the second largest challenge facing airlines. This has moved up the list of top ten risks from position nine to two.

This year’s survey also highlights that the war for talent is rising sharply up the agenda for the industry, with airlines competing fiercely to attract (and keep) skilled candidates. While nine of the top ten risks remained consistent between the 2017 and 2018 surveys, the new entrant to the top ten is the challenge of recruitment and retention. This is in at number nine, with access to capital and liquidity (number ten in 2017 – see last year’s results here) falling out of the top 20 this year.

And the top threat facing the industry? For the third year in a row, the greatest risk that’s facing global airlines is each other. The 2018 survey, recently released, included finance leaders from airlines around the world, and provided insights for both the Americas (North and South) Europe, the middle East, India and Africa (EMEIA) and Asia Pacific and Japan (APAC), with the listing below showing the combined global view. In all jurisdictions surveyed, competition was deemed to be the number one risk for the third year running.

Recruitment and retention moved up 11 spots from 20 in 2017 to number nine this year, and is the most significant movement in the year. As mentioned, given the varying cost of oil, fuel prices moved up seven spots, from number nine to two.

Replacement of aging aircraft continues to move up the agenda, rising from 17 to 14, which is good news for lessors seeking to place new orders. Conversely, the most significant downgrade was a five spot fall from position three to eight for strategic initiatives for revenue growth and maximisation. Threats from low cost carriers fell by five spots also from 11 to 16.

Competition is the number one risk overall followed by fuel prices at number two. Each of the three regions rate these risks in the top three with competition being the main risk in the Americas and Asia Pac and in third spot in EMEIA. Fuel prices claims the top spot in EMEIA and is number two in both the Americas and Asia Pac. Strategic initiatives for revenue is a greater focus area for the Americas where it comes in at position four, while falling outside the top to for both EMEIA and Asia Pac.

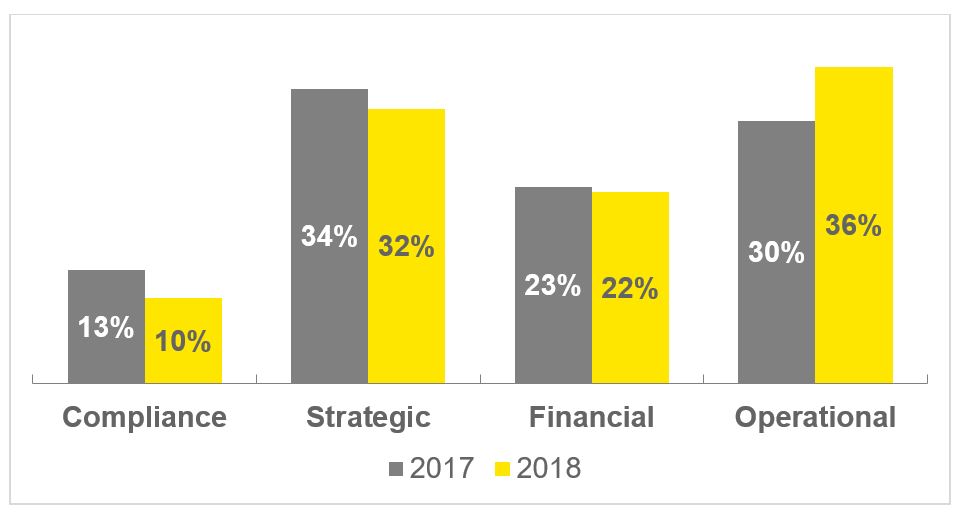

Strategic risks were the most prevalent in the top 20 risks in 2018 at 34% (up two from 32% in 2017), surpassing operational risks which was the largest element in 2017 and makes up 30% of the risks in 2018 (down from 36% in 2017). Compliance risks increased by 3% from 10% in 2017 to 14% and financial risks were up 1% to 23% from 22%.

| 2018 | Risk |

| 1 | Competition |

| 2 | Fuel prices |

| 3 | Cost control |

| 4 | Safety management |

| 5 | Data intelligence threats and cybercrime |

| 6 | Technology enablement |

| 7 | Macroeconomic factors |

| 8 | Strategic initiative for revenue growth |

| 9 | Recruitment and retention |

| 10 | Business interruption |

| 11 | Foreign exchange |

| 12 | Labor negotiations |

| 13 | Regulatory compliance risk |

| 14 | Replacement of aging aircraft |

| 15 | Contract and vendor management |

| 16 | Threat from low-cost company |

| 17 | Terrorism |

| 18 | Customer facing innovation |

| 19 | Industry consolidation and alliances |

| 20 | Geopolitical unrest |